North America continues to lead global ecommerce growth, offering vast opportunities for sellers and brands across the USA, Canada, and Mexico. As of 2024, North America’s ecommerce market reached approximately US $1.29 trillion, and it is forecasted to more than double to US $3.13 trillion by 2032.

Each market has unique consumer behaviors, infrastructure, and marketplace preferences that shape its ecommerce potential.

Explore this guide to uncover the top marketplaces across North America, including both established giants and rising stars. Whether you’re expanding from the US into Canada and Mexico or just starting your multichannel journey, these marketplace insights will help you prioritize where to sell and how to succeed.

North American marketplaces: It's not only the US!

Of course, many people naturally think of the USA as the prime market in North America (and it is), but it’s important to recognize the potential across the whole region.

The North American market consists of 23 independent states, ranging from Caribbean islands like Sint Maarten and Bermuda to larger countries like Canada and Mexico. Many of these can offer a far greater possibility for organic sales growth.

North American consumers love to shop online, and selling on marketplaces is the best way to connect with them. However, when prioritizing which countries to target, it makes sense to go for the biggest fish in the pond: the largest markets, and the biggest marketplaces in those countries.

The biggest marketplaces in North America

The largest ecommerce markets in North America are the USA, Canada, and Mexico. As all three of these are members of the North American Free Trade Agreement (NAFTA), trade between these countries is very easy.

It’ll come as no big surprise that Amazon has the greatest market presence in all three major markets, but there are many more channels to consider if you want to reach every possible customer.

To capture the best market share, a multichannel approach is called for. Each country has distinct preferences for different marketplaces, and many of the smaller North American countries tend to follow the trends of their larger neighbors, depending on factors like language, accessibility, payment, and shipping options.

The top marketplaces in the USA

#1: Amazon

Amazon remains the cornerstone of multichannel ecommerce strategy in the US. With billions of monthly visits and an extensive Prime subscriber base, Amazon offers unmatched reach. However, sellers must focus on performance, branding, and smart pricing to stay competitive.

Category focus: All categories – especially Electronics, Fashion, Beauty, and Home.

Special features: Fulfillment by Amazon (FBA), Prime eligibility, robust advertising suite, and A+ content tools.

Strongest in: Nationwide, with especially high traction among Millennials and Gen X.

Find out more about becoming a seller on Amazon here.

#2: Walmart

Walmart Marketplace offers a growing and accessible opportunity to expand your reach, especially if you're targeting value-driven shoppers. With a strong in-store and online presence, this platform supports seamless cross-border selling into Canada and Mexico.

Category focus: General merchandise, Electronics, Home, Apparel, and Pharmacy items.

Special features: Walmart Fulfillment Services (WFS), Buy Box mechanics, and Walmart Connect advertising.

Strongest in: Suburban areas and price-sensitive demographics.

Become a seller on Walmart marketplace with ChannelEngine.

#3: eBay

eBay remains a vibrant marketplace with strong search visibility and customizable storefronts. Ideal for moving high volumes or specialized inventory, eBay rewards clarity, competitive pricing, and strong imagery.

Category focus: Electronics, Fashion, Collectibles, Automotive, and more.

Special features: Auction listings, Promoted Listings, and strong buyer engagement tools.

Strongest in: Price-conscious consumers and niche product hunters.

To find out more about how to start selling on eBay, click here.

#4: Target

Target+ offers sellers a unique space within a trusted US retail brand. Its curated nature ensures premium positioning and higher margins, ideal for brands with strong DTC potential and a clear identity.

Category focus: Lifestyle, Fashion, Electronics, and Home.

Special features: Invitation-only access, brand storytelling, and curated campaigns.

Strongest in: Urban, trend-conscious households, especially Millennials

If you want to start selling on Target Plus, then you’ll need to get invited – but you can save your place in the line now by filling in this form. To get the best chance of being accepted as a Target+ seller, we recommend having a chat with your ChannelEngine customer success managers, who can advise you on the ideal course of action.

#5: Wayfair

Wayfair is the go-to for home-centric categories. Its partner model and dynamic pricing allow sellers to reach targeted audiences while retaining operational control through drop-ship or CastleGate.

Category focus: Furniture, Home, and Garden.

Special features: CastleGate Fulfillment, wholesale-based pricing model, and high AOV.

Strongest in: Homeowners and renters in suburban and urban markets.

Find out more about selling on Wayfair.

#6: Macy’s

Macy’s allows brands to tap into a loyal, fashion-forward audience. For lifestyle and apparel sellers, the platform’s curated approach and emphasis on storytelling provide a perfect match.

Category focus: Fashion, Beauty, Home, and Gifts.

Special features: Macy’s Media Network, iconic sales events, and branded storefronts.

Strongest in: Fashion-conscious middle-income households.

Want to become a seller on this marketplace? Check out our Macy's marketplace guide.

#7: Kohl’s

Kohl’s combines its strong offline footprint with online marketplace convenience. The result is a platform perfect for everyday essentials, especially for brands that thrive on bundles, loyalty incentives, and seasonal promotions.

Category focus: Apparel, Baby items, Household, and Toys.

Special features: Kohl’s Cash promotions, influencer campaigns, and loyalty integrations.

Strongest in: Female shoppers aged 25–54 and value-driven families.

Find out more about selling on Kohl’s

#8: TikTok Shop

TikTok Shop is redefining social commerce. By integrating video, trends, and viral content into product discovery, sellers can build brand trust, drive engagement, and boost conversions through creative storytelling.

Category focus: Beauty, Fashion, Lifestyle.

Special features: Influencer partnerships, short-form video commerce, and Spark Ads.

Strongest in: Gen Z and Millennial shoppers.

Find out more about selling on TikTok Shop

#9: Best Buy (US)

Best Buy offers a high-trust environment and a strong omnichannel experience for electronics brands looking to tap into both B2C and B2B segments.

Category focus: Consumer Electronics.

Special features: Sponsored product ads, in-store pickup, and seasonal tech promotions.

Strongest in: Tech-savvy, middle-income US households and B2B buyers.

Want to become a seller on this marketplace? Check out our Best Buy US marketplace guide.

#10: Temu

Temu has rapidly become a dominant force in discount-driven ecommerce, known for its ultra-competitive pricing, gamified promotions, and wide assortment of low-cost products. Its explosive growth and viral marketing campaigns make it a top destination for budget-conscious consumers across North America.

Category focus: General merchandise, Fashion, Electronics, Lifestyle, and Home items

Special features: Deep discount model, free/low-cost shipping, gamified shopping experience, and heavy mobile-first focus

Strongest in: Price-sensitive shoppers, especially Gen Z and Millennials

#11: SHEIN

SHEIN is quickly becoming a powerhouse for trend-responsive brands. It rewards sellers who are agile with inventory and excel in visual content.

Category focus: Fashion, Beauty, and Lifestyle accessories.

Special features: Rapid refresh cycles, gamified shopping experience, and mobile-first approach.

Strongest in: Gen Z and fast-fashion shoppers.

Find out more about selling on SHEIN

#12: Etsy

Etsy is the go-to for creative and custom items. If your brand offers uniqueness and story-driven products, Etsy is a natural fit.

Category focus: Handmade goods, Vintage, Craft supplies, and Personalised products.

Special features: Customization options, SEO-rich listings, and seasonal promotions.

Strongest in: Gift buyers, creatives, and DIY enthusiasts.

#13: Nordstrom

Nordstrom appeals to aspirational and luxury-focused consumers. Ideal for brands that value aesthetics, service, and exclusivity.

Category focus: Premium Fashion, Beauty, and Accessories.

Special features: Curated collections, image and branding guidelines, and seasonal exposure events.

Strongest in: High-income, fashion-savvy shoppers.

Find out more about selling on Nordstrom.

#14: Reverb

Reverb gives music-related brands access to a niche but passionate audience. Listings benefit from transparency and detailed condition notes.

Category focus: Musical Instruments and Accessories.

Special features: Used gear listings, gear bundles, and seller branding tools.

Strongest in: Musicians and collectors.

Find out more about selling on Reverb

#15: Overstock

Overstock (a Beyond Inc. channel) is great for clearing seasonal inventory and finding new buyers looking for quality home items at attractive prices.

Category focus: Home, Décor, and Clearance Inventory.

Special features: Discount-driven pricing, email marketing, and clearance events.

Strongest in: Deal hunters, especially female shoppers aged 45+.

Find out more about selling on Overstock.

#16: buybuyBaby

A focused marketplace for sellers of baby and parenting products, buybuyBaby is also a Beyond Inc. channel. The registry and loyalty ecosystem offers great long-term value.

Category focus: Baby products, Toys, and Essentials.

Special features: Registry integration, seasonal baby events, and curated bundles.

Strongest in: New parents aged 25–34.

#17: Lowe’s

Lowe’s is a powerhouse in the home improvement category, offering a trusted platform for professional contractors and ambitious DIYers. Its marketplace connects sellers to a highly engaged audience through performance-driven features and pro-grade shopping experiences.

Category focus: Hardware, DIY, Tools, Appliances, Garden, and Automotive.

Special features: Pro Rewards, MyLowe’s loyalty program, in-store returns.

Strongest in: Contractors, tradespeople, and hands-on homeowners.

Find out more about selling on Lowe’s.

#18: Newegg

Newegg is the go-to marketplace for tech-savvy consumers. With deep roots in electronics and gaming, it’s a prime choice for brands with complex or performance-based products that need the right technical presentation to convert.

Category focus: Consumer Electronics, PC parts, Gaming accessories.

Special features: Shell Shocker Deals, SBN fulfillment, tech-focused filtering.

Strongest in: Gamers, early adopters, and tech-savvy shoppers.

Find out more about selling on Newegg.

#19: Bed Bath & Beyond

Reimagined under the Beyond Inc. umbrella, Bed Bath & Beyond offers a curated ecommerce destination for home brands looking to reach value-focused, gift-oriented shoppers. With loyalty perks and registry tie-ins, this channel supports strong customer lifecycle engagement.

Category focus: Home, Furniture, Kitchen, and Lifestyle.

Special features: Registry, Beyond+ loyalty, and gamified promotions.

Strongest in: Home-focused female consumers aged 45–64.

Find out more about selling on Bed Bath & Beyond.

#20: Urban Outfitters Group (UO MRKT)

UO MRKT is the digital marketplace of the Urban Outfitters Group, built for brands that resonate with youthful, edgy, and style-forward shoppers. Sellers benefit from curated placement alongside trend-leading products within a fashion-conscious ecosystem.

Category focus: Fashion, Lifestyle, and Home Decor.

Special features: Invitation-only marketplace, curated product mix, and visual storytelling.

Strongest in: Trend-driven young adults aged 18–30.

Second biggest ecommerce market in North America: Canada

Compared to the USA, Canada is a much smaller market. However, it ranks the largest ecommerce market in the world, and it’s still growing.

With a population of 41.0 million people in 2024, Canada has fewer residents than the US state of California but covers a greater surface area than the entire USA. As a result, the population density is much lower (about 4.2 people per km2) and this means that delivery times can be longer. Provided your customers are given reasonable expectations and access to parcel tracking information, this rarely causes any problems.

It’s also worth being aware that French is the mother tongue of about 20.6 percent of Canadians, while roughly 29 percent speak French (either as a first or additional language). Localizing your content will be important for optimizing success in this market.

Over 27 million Canadians, about 75 percent of the population, shopped online in 2022. That proportion is expected to reach 77.6 percent by 2025. Ecommerce’s share of total retail is rising steadily. As of December 2024, it accounted for about 6.1 percent monthly, and annual forecasts suggest it will make up 13.0–13.4 percent of all retail sales in 2025.

The top marketplaces in Canada

#1: Amazon

Canadians spent some US$28.8 billion on Amazon in 2022. Both the Amazon.com and Amazon.ca websites are used by Canadians. However, as a clear demonstration of the power of localization, the Canadian site is significantly more popular, gaining 182 million visitors, versus 25.9 million Canadians visiting the Amazon.com website each month.

#2: Walmart

Walmart.ca is a major player in Canada with 32.6 million monthly visitors. Canadian consumers spent US$8.9 billion on Walmart.com in 2022, and Walmart is keen to support the growth of their Canadian marketplace platform.

To assist US-based sellers, Walmart offers a Ship With Walmart (SWW) program and Walmart Fulfillment Services (WFS) to help make cross-border selling much easier. If you want to start selling on Walmart Canada Marketplace, then you can apply here.

However, to maximize your chances of being accepted it is recommended you discuss the requirements with your Customer Success Team representative. Walmart’s strongest competitor in the Canadian market is probably Canadian Tire, however they are yet to launch a marketplace platform. If they do, be prepared to pounce.

#3: eBay

eBay is the third most popular marketplace with Canadian shoppers, who spent US$2.4 billion on eBay.ca and eBay.com in 2022. Some 26.2 million consumers visit the eBay.ca marketplace each month, attracted to the wide variety of goods across every category imaginable. Some of the most demanded categories on eBay Canada are Men’s Clothing, Fragrances, and Computers – but pretty much everything will find a buyer here. If you’re not sure about price points, you can use the eBay tool Terapeak, which gives insight into real-time price trends and other selling data.

#4: Tmall

This is where we start to see a divergence from Canada’s southern neighbor. Tmall is the world’s third most popular marketplace, with a huge following in China. Tmall was spun out of the parent business Taobao in 2008, to better serve consumers who wanted to buy directly from brands and retailers.

Tmall is the fourth most popular marketplace among Canadians, and has a dedicated portal for Canadian customers, who spent US$1.68 billion on the platform in 2022. Tmall is a major global marketplace, with annual GMV of US$616.8 billion worldwide in 2022. As Canada has a significant Chinese diaspora population (1.7 million Canadians, or 4.3% are of Chinese origin), this may account for the popularity of Tmall in Canada.

#5: AliExpress

Like Tmall, another Chinese marketplace that’s wildly popular in Canada is AliExpress. Both Tmall and AliExpress are part of the Alibaba group, and AliExpress started as a B2C spin-off from the B2B sourcing platform Alibaba.com. Some 20.1 million Canadians visit AliExpress each month, and some US$0.95 billion in GMV was generated by Canadian customers in 2022.

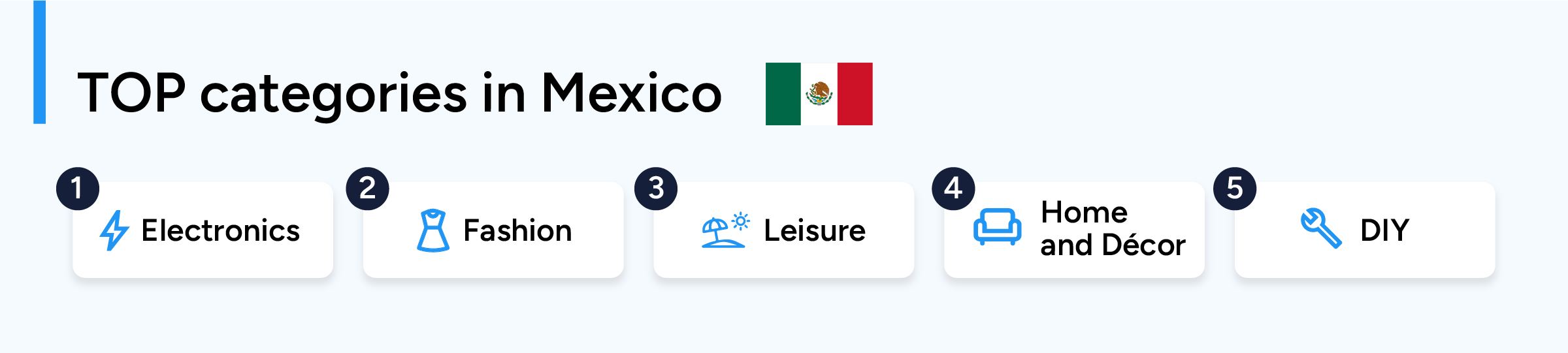

The third biggest ecommerce market in North America: Mexico

With a population of 131.9 million people, Mexico remains a key market for brands focused on organic growth.

As of 2024, its ecommerce market size was approximately US $47.5 billion. Forecasts indicate dramatic expansion ahead, rising to US $176.6 billion by 2033, at a 14.5 percent CAGR between 2025 and 2033. More recent data from PCMI suggests even faster acceleration, with e‑commerce projected to jump from US $97 billion in 2024 to US $184 billion by 2027, implying a 24 percent CAGR.

Internet coverage is now widespread: around 85 percent of the population was online in 2024, and this figure is expected to grow to 94 percent by 2029. Given Mexico’s growing population of connected buyers and its double‑digit e‑commerce growth trajectory, the country is well-positioned to overtake Canada as the #2 e‑commerce market in North America. The growth potential here is substantial—and it opens the door to broader Latin American expansion.

The top marketplaces in Mexico

#1: Amazon

Amazon is just as popular in Mexico as in the USA (and the rest of the world). Both Amazon.com and Amazon.com.mx are used by Mexican consumers, but the localized version is preferred. Amazon generated US$9.3 billion GMV in Mexico in 2022.

#2: MercadoLibre

Mercado Libre means ‘free market’, and it’s an incredibly popular platform across Latin America. It all began in 1999 in Marcos Galperin’s garage in Buenos Aires. Seven years later, and it was the largest ecommerce platform in Latin America (until Amazon entered the market in 2012).

The MercadoLibre.com.mx website attracts about 104.5 million visitors each month, and generated GMV of US$6.3 billion in 2022.

#3: Walmart

Walmart has a powerful presence across North America, including Mexico. Retailers will be glad to know that the Walmart marketplace is also available in Mexico. The history of Walmart in Mexico may be surprising, as it goes back further than you might think. Walmart’s Mexican branch, Wal-Mart de Mexico, S.A. de C.V, began as Cifra, a Mexican retailer which was founded in 1952. Walmart starting buying a growing stake in Cifra until 1997 when it had a controlling share and changed the name to Wal-Mart de Mexico. Mexican consumers spent US$1.47 billion with Walmart.com.mx in 2022.

#4: Coppel

Originally an electronics retailer Coppel is now a busy marketplace for third-party sellers, with significant reach in this growing market. An impressive 40.2 million consumers visit the Coppel marketplace every month. The total GMV Coppel generated in the Mexican market in 2022 was over US$1 billion, which is 8.1% higher than 2021.

#5: Linio

Since 2018, Linio.com.mx has been part of the Chilean Falabella group. Linio is a strong local online marketplace in Mexico, however it’s likely that the Linio marketplace will eventually be rebranded under the Falabella name, which already has a strong following across Latin America.

Linio receives 24 million monthly visitors and offers products from more than 8000 professional sellers. Their app has been downloaded 13.9 million times, and Linio has a presence in 4 key Latin American markets.

…and many more North American marketplaces to consider!

Besides the biggest marketplaces in North America outlined above, there are many more to think about, depending on whether they fit with your business model and target customer.

.png?width=960&height=540&name=Top%20marketplaces%20-%20North%20America%20(1).png)

.png?width=360&height=202&name=ecommerce%20predictions%202026%20(1).png)