Marketplace sellers have never been more ambitious. The average seller is now active on six marketplaces, and more than one-third (34%) have already expanded to seven or more. The drive to grow is undeniable, but the ability to keep that momentum is another story.

For many, marketplace growth has hit an invisible ceiling. Every new channel brings fresh sales opportunities, but new complexity, technical demands, and resource strain. Sellers want to go further, faster, yet find themselves increasingly bogged down by the very systems that helped them scale.

The growth illusion

On paper, marketplace commerce looks like a success story. Sellers are multiplying their presence, chasing reach and relevance across a landscape that’s growing by the week. But behind that expansion is a widening gap between ambition and execution.

The Marketplace Seller Trends Report 2025 reveals the contradiction: while sellers recognize marketplaces as their biggest growth channel, technical complexity, resource limitations, and cautious budgets are keeping that growth in check.

What’s emerging is a kind of “growth illusion.” Many sellers are growing horizontally by adding more channels but, struggling to grow operationally. Every marketplace adds layers of data mapping, compliance, and category management. Instead of scaling with confidence, sellers find themselves stretched thin, chasing fixes instead of driving strategy.

Why has growth stalled

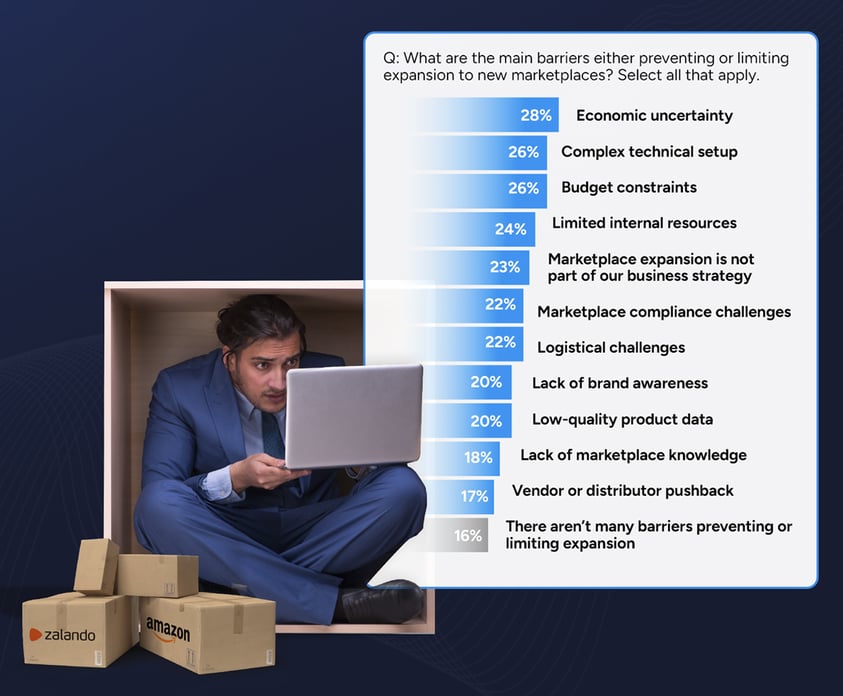

When asked what’s stopping them from expanding further, sellers pointed to three main obstacles:

- Technical complexity (26%) – Even with integrators and automation tools, onboarding a new marketplace still means tackling new APIs, taxonomies, data mapping, and compliance.

- Limited internal resources (24%) – Marketplace management is resource-hungry, and many teams are already stretched thin just maintaining what they have.

- Economic uncertainty and budgets (28% and 26%) – Even growth-focused brands are pausing to protect margins in volatile conditions.

What these numbers show is that sellers aren’t pulling back because of lack of opportunity, they’re simply at capacity. Growth ambitions are clashing with the realities of day-to-day management. Many teams are asking not “Where should we expand next?” but “How can we handle what we already have?”

This is where the paradox truly emerges: marketplace sellers are surrounded by opportunity but constrained by infrastructure. The tools that enabled early marketplace success now struggle to keep up with the scale and complexity sellers face today.

Download the full report: Marketplace Seller Trends Report 2025

The expansion challenge is just one of several critical findings from our research. The Marketplace Seller Trends Report 2025 digs into:

- How many marketplaces sellers are active on today, and which platforms are leading in each region.

- The top priorities sellers are setting for 2026 as they balance reach and profitability.

- Where sellers expect the next big shifts in ecommerce to come from (hint: AI is a major theme).

The manual work trap

Behind every stalled expansion is another silent culprit: time. The report shows sellers are losing 36% of their working week (nearly two days) to manual marketplace tasks. For one in five, it’s half their week gone.

That means fewer hours to optimize listings, fewer resources to onboard new channels, and little energy left for strategy. In short, sellers aren’t struggling to grow because they lack vision, they’re struggling because they lack bandwidth.

We explored this in detail in our recent post, Automation or Stagnation? The Hidden Cost of Manual Marketplace Work, which dives deeper into how manual processes are quietly capping sellers’ growth potential.

Manual work has become the hidden tax of marketplace commerce. Sellers know automation is key, but many are still tied to fragmented systems that require constant oversight. The result? Every step toward expansion feels heavier than the last.

Local complexity, global pressure

Expansion is no longer about simply “adding another marketplace.” It’s about mastering the local nuances of each one. While Amazon still leads across every region, local champions like Walmart in the US and Bol in the Netherlands show that sellers can’t ignore regional diversity.

Each marketplace comes with its own category logic, listing rules, compliance demands, and fulfillment expectations. Sellers now face the challenge of being globally ambitious yet locally precise. Without a connected operational backbone, this balancing act turns into chaos.

In other words, the more global sellers become, the more localized their operations need to be. And managing that tension manually, or across disconnected systems, is no longer sustainable.

A turning point for marketplace sellers

Even though 98% of sellers say they’re satisfied with their integrator, a striking 66% plan to switch providers in the next 12 months. That’s not comfort, it’s quiet frustration. Sellers are realizing that “good enough” isn’t enough anymore. They’re looking for integrators that can move at their speed—platforms that enable faster onboarding, centralized control, and reliable automation that actually works across every channel.

This signals a clear shift in mindset: sellers are no longer choosing tools just for connectivity, but for scalability. The next wave of marketplace winners won’t be defined by how many channels they’re on—but by how well they can manage them all.

Why the right integrator matters

Marketplace growth shouldn’t feel like a juggling act. And not every integrator is equipped to handle the new realities of marketplace commerce, especially at speed and scale. That’s where ChannelEngine stands out.

We’re not just another multichannel connector. At ChannelEngine, we’ve built a growth platform designed to help you scale smarter - connecting you to hundreds of global and regional marketplaces while removing the friction between ambition and execution. Our platform offers:

- Faster onboarding and simplified integration for new channels.

- True automation that removes repetitive manual work.

- Centralized control of inventory, pricing, content, and fulfillment.

- Scalability by design, so your operations grow as fast as your vision.

With guidance from our marketplace experts, you’ll have the insight and support to expand faster and smarter across every channel.

Break the expansion barrier

The expansion paradox is real, but it’s not permanent. We know that as an ecommerce brand, you already have the vision, the products, and the drive to grow. What’s missing is the right infrastructure to support it. That’s where our expertise comes in. We help you remove friction, reclaim time, and scale smarter, so your marketplace potential becomes real growth.

.png?width=152&height=152&name=Nishkarsha%20(1).png)