How to make a splash through global marketplaces

How to make a splash through global marketplaces

Covid-19’s disruption of the Australian retail industry may finally be settling, but its impact on the local e-commerce market will have a lasting legacy.

Almost two years have passed since Australia went into snap lockdowns nationwide to curb the rapid spread of the coronavirus. In that time, the nation’s retailers have been forced to contend with additional lockdowns, major production, and supply disruptions, and, most dramatically, an overnight pivot to online shopping from consumers.

In this short, but turbulent period, Australia’s e-commerce industry has undergone a massive transformation.

During the pandemic’s first 14 months, Australia’s e-commerce market grew from around 9 percent of the overall retail market share to 13 percent. This year, Australian e-commerce revenue is projected to reach $45 billion USD as consumers increasingly expect e-commerce as a standard retail offering.

Online shopping marketplaces are the most accessible route for retailers either trying to launch an e-commerce business or attempting to achieve a wider global scale. These are essentially online shopping malls that provide a convenient shopping platform for consumers.

In 2020, almost half of the world’s e-commerce sales took place on online marketplaces, amounting to nearly US$2 trillion. In Australia and New Zealand, eBay, the region’s most popular marketplace, regularly draws in 61 million monthly users, followed by Amazon with 28.5 million visitors per month. These phenomenal numbers are only set to continue growing.

Beyond the borders

Australia may be a thriving online retail market, but selling solely domestically will severely limit businesses’ growth potential. According to research from Auspost, 99.9 percent of global e-commerce spending sits outside Australia. That’s a massive window of opportunity not being taken advantage of.

This approach appears to be very common. Recent research suggested that only a fifth of Australian retailers currently use marketplaces to reach international customers.

Even scaling into neighboring New Zealand brings significant potential. The e-commerce market there is healthy, well-established, and boasts some thriving local players – countdown.co.nz, mitre10.co.nz and thewarehouse.co.nz –, which collectively account for 20 per cent of New Zealand’s online revenue. Indeed, New Zealand e-commerce sales generated revenue of US$4 billion in 2021.

Given these factors, alongside New Zealand’s dependence on imported goods and relative proximity to Australia, the Trans-Tasman should be the first port of call for local businesses looking to scale internationally. But the Tasman is not the limit; indeed far from it. The marketplace economy allows Australian retailers to be much more ambitious.

North America unsurprisingly generates the most traffic to online marketplaces, totaling 4.4 billion user visits per month. Europe, meanwhile, has the highest number of different marketplaces, which draw a total of over 3.7 billion visits from the continent’s shoppers. As an emerging market, Southeast Asia is showing strong growth in the marketplace arena, drawing an average of 710 million monthly visitors. These marketplaces are all ripe for Australian retailers to tap into cross-border sales and widen their regional footprint.

For some markets, receiving goods from overseas is not unfamiliar. According to a 2018 survey by online payments company PayPal, 57 percent of consumers in both Western Europe and Eastern Europe and 48 percent in the Asia Pacific (APAC) buy from retail websites outside their own country.

Although this may seem the most logical inroad for Australian businesses, it may not bring the most long-term gain. Leveraging international or globalized sellers instead will provide the maximum return on investment. This is evident from the numbers; the world’s top 100 marketplaces all receive over 7.5 million monthly visits, while global behemoths Amazon and eBay see more than a billion. Following Amazon and eBay are the localized giants of Latin America’s Mercado Libre, Japan’s Rakuten, and Southeast Asia’s Shopee, all of which receive over 450 million visits per month each. The potential for mass reach and sales growth is gargantuan.

In terms of product categories, the top 20 marketplaces overwhelmingly sell general merchandise, including electronics and fashion. Only three specialize in a specific category, with Etsy, the largest of these marketplaces, standing out for its incredible success in the arts and craft space.

Regardless of a business’ niche, there will always ultimately be a marketplace suitable for them. The first step is simply choosing which suits your product and consumer market and building from there.

No more rigmarole

Overseas expansion is a daunting task even for the most seasoned business leaders. Marketplaces at the very least can serve as launchpads into a new market, providing both visibility and growing brand awareness. Leveraging a well-established marketplace will also help businesses test the water in unfamiliar territory and eventually build trust with consumers.

Once this initial phase is completed, brands can deepen their marketing and customer acquisition investments, putting them on a path to increase sales and overall revenue.

Reaching consumers overseas is far simpler for businesses today thanks to online marketplaces. Although in-country distributors or wholesalers are still required for local expertise and logistics, retailers no longer have to launch a new website for each country, complete with localization for each language. Online marketplaces erase these barriers while offering a faster and more efficient route to market. Additionally, marketplaces relieve the cost burden of accepting payments in multiple currencies.

Once established, brands can take advantage of the insights generated by marketplaces, such as on pricing, consumer demand, and competition. Knowing this data gives a brand’s marketing team insight into how to improve its campaign strategy and product positioning. These will ultimately enable a brand to yield optimizations and improve its sales margins.

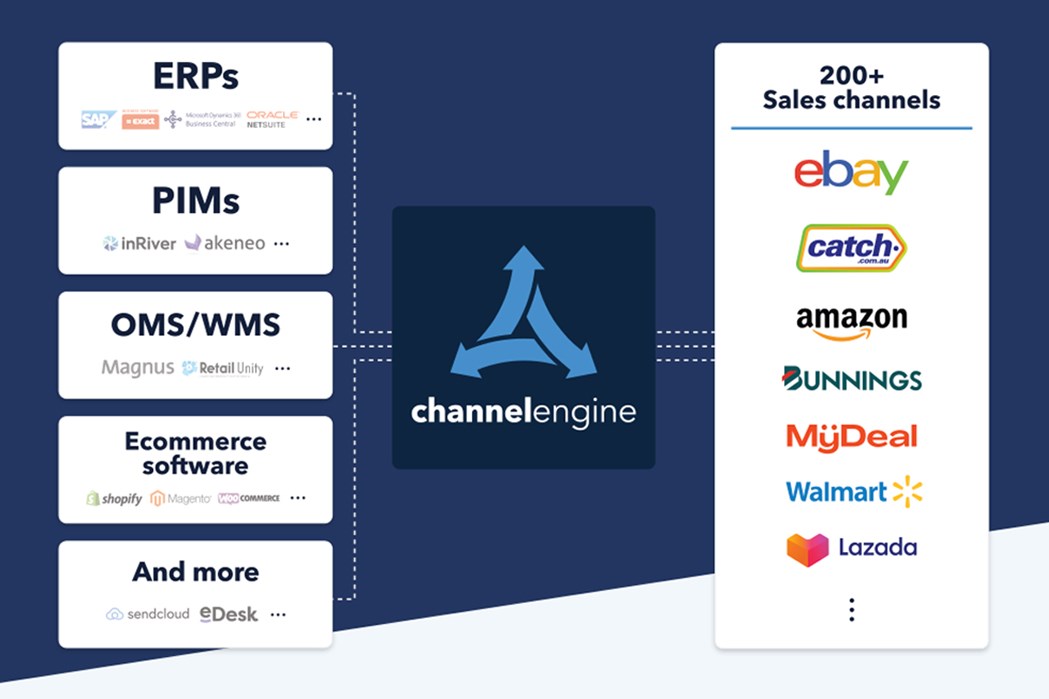

So what role does ChannelEngine play in this marketplace journey? For Australian businesses looking for a stepping stone to a new market, ChannelEngine offers access to over 200 marketplaces worldwide.

Its complete e-commerce and marketplace management suite operate as a control center, bridging the gap between internal systems and all digital sales channels. ChannelEngine helps boost international sales with tools such as automated repricing, content, stock, and order management. Australian businesses can offer consistent brand experience and streamline operations to reach millions of customers. With ChannelEngine’s out-of-the-box solution and thriving partner network, selling on marketplaces has never been easier.

ChannelEngine’s solution also comes with a number of automated processes such as built-in duties and goods and services tax (GST) calculations, as well as expertise from its local and international teams.

Both home and away, ChannelEngine can also help Australian sellers expand their domestic marketplace footprint with advice, insights, and management tools for sales, pricing, inventory, and shipments. The world is your oyster with marketplaces – you simply need a hook to make that first splash.

Request a demo and learn how to make a smooth connection to some of the most promising marketplaces.